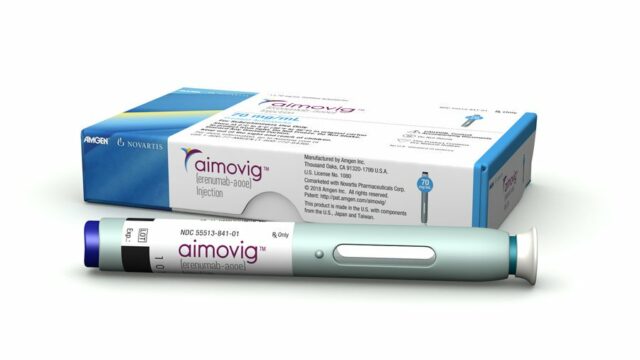

Amgen had a head start with its first-to-market CGRP launch Aimovig, but its rivals are giving the company some fierce competition.

As of the week ended August 23, Aimovig now holds less than half of the total CGRP market, a first for the drug. In recent weeks, it had been hovering at or above 50%.

Eli Lilly’s third-to-market Emgality, which held 31% of the market as of the week ended August 23, is the only med in the class that’s been growing market share over the last 8 weeks, SVB Leerink analysts wrote in a note detailing IQVIA prescription data.

Meanwhile, Teva’s Ajovy is holding third place in the market share race with 20% of total prescriptions. Over the last two months, Lilly has grown its market share 3%, while Teva has lost 2% and Amgen lost 1%, according to IQVIA data.

CGRP migraine prevention drugs won approvals starting in May last year and are each important for their companies for similar reasons. Each company is dealing with patent expirations, so the closely watched CGRP launches are helping offset declines elsewhere. Teva, in particular, doesn’t have many growth drivers, so Ajovy is playing an outsized role in the company’s outlook.

RELATED: Amgen’s Aimovig won its first-in-class migraine nod. Will payers step up to the $6,900 price?

In the sales race, Amgen holds the lead. Aimovig bested its competition in second-quarter sales with $83 million, followed by $34 million for Emgality and $23 million for Ajovy. Each company started its launch by offering free drugs while payer negotiations played out, so they’re now working to move patients over to paid scripts.

On Lilly’s second-quarter conference call, CFO Josh Smiley said the company captured 41% of the share of new prescriptions at the end of the quarter, up 9% from its position at the end of Q1. He said the company has “best-in-class access” and anticipates Emgality “contributing meaningfully to sales in the second half of 2019.”

It’s still early in the race, though, Amgen’s Murdo Gordon, EVP of global commercial operations, said on his company’s Q2 conference call. So far, market penetration is low, as there are 4 million eligible patients in the U.S., he said. Seven thousand patients are starting CGRP drugs per week, he noted, and 27,000 doctors have prescribed Aimovig so far.

On Teva’s Q2 call, CEO Kåre Schultz said his company is “satisfied” with Ajovy’s total prescription market share. Teva expects a little under $150 million in sales from the drug this year, he added. Looking ahead, the company anticipates the approval of an Ajovy autoinjector to bolster the launch.

RELATED: Lilly’s scored its cluster headache nod for Emgality. Will it shake up the CGRP race?

While each drug is approved to prevent migraines, Lilly’s Emgality also recently won an FDA nod to treat patients with cluster headache, becoming the first drug ever approved in the indication.