Source: J.P. Morgan

To call 2020 a “unique year” for life sciences companies would be an understatement. The COVID-19 pandemic transformed the industry, creating immense opportunities for institutions and investors to drive healthcare through innovation.

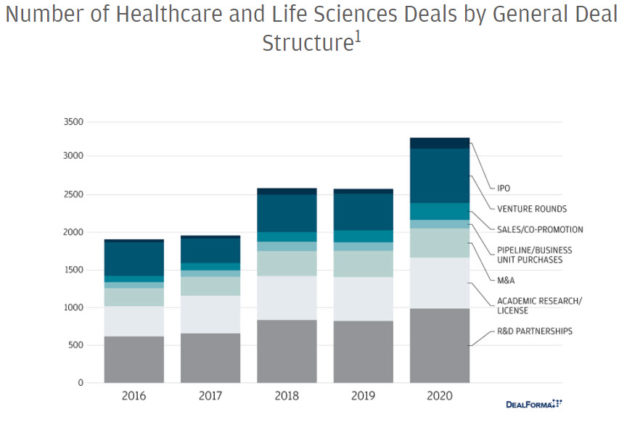

Peter Meath, Co-Head of Healthcare and Life Sciences for Middle Market Commercial Banking at J.P. Morgan, notes that investment in life sciences reached record-high levels across almost every category and subsector—despite unprecedented business challenges. Here are a few of the highlights:

- 3Q 2020 was the largest quarter on record in terms of dollars for venture investment in life sciences

- Alternative sources of capital rose as well, including:

- Corporate venture capital (CVC) and corporate partnerships

- Up-front payments and deal terms on partnership deals

- Non-traditional investors, including individuals, angels, family offices, corporates and even hedge funds

Mega rounds—VC funding in excess of $100 million—continued to increase across biopharma, medical technology, and tools and diagnostics. Meath says the “go big” trend of larger fund sizes, i.e., mega funds, could continue to play a larger role in the funding ecosystem as well.

Activity within life sciences subsectors evolved as investors adjusted to the ebb and flow of the economic and business landscape during the pandemic.

“Biopharma notably had a banner year, and we’ve seen some interesting moves in tools and diagnostics, pharma services and healthcare IT funding, not just among our clients, but in the industry overall,” Meath says.

To take a deeper dive into these subsectors, follow this link.

- DealForma, data as of 1/7/2021. Healthcare and Life Sciences sector coverage across biopharma, medtech, device, diagnostics, tools, CDMOs, and related companies. Financials based on disclosed figures. M&A are for whole company acquisitions (or majority acquisitions) and not product, pipeline, or business unit purchases. Excludes terminated offers. Partnerships involving development and commercialization, joint ventures, options to license, partnerships with an option to acquire the company, and research partnerships. Excludes regional sales/distribution only and academic/government deals.