The first wave of cancer drugs that clear the way for a certain immune cell to gobble up tumors has yet to reach the market, but Arch Oncology is already developing what it calls the “next-generation” of this type of cancer immunotherapy and it has raised $105 million in fresh capital to advance multiple clinical tests of its lead asset.

The Series C financing announced Tuesday was co-led by Eventide Asset Management and Cowen Healthcare Investments, both new investors to the company, as well as earlier investor 3×5 Partners.

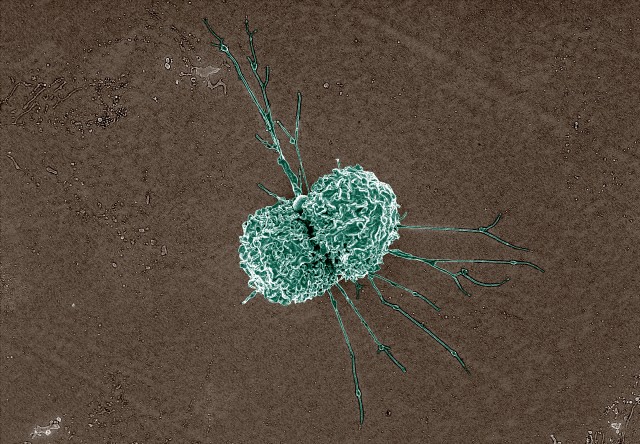

Brisbane, California-based Arch is developing drugs that target CD47, a cancer protein that sends out a signal immune cells interpret as “don’t eat me.” Drugs that block this protein enable immune cells called macrophages to recognize the tumor cells and munch away at the tumors.

The problem with this approach, called autophagy, is that red blood cells also express CD47 and a drug that blocks the protein on tumors can also block it on red blood cells. Consequently, macrophages see red blood cells as something to eat. Plummeting red blood cell counts lead to anemia.

Like other CD47-blocking drugs, Arch is developing antibodies that block the mechanism by which tumors evade macrophages. But the company is developing drugs that it says can spare normal cells. In addition to blocking the “don’t eat me signal” to clear the way for autophagy to occur, the company says its drug shows a lower propensity for binding to normal cells, including red blood cells. Furthermore, the drug has enhanced binding properties in low pH environments, such as the area immediately surrounding the tumor. By contrast, normal cells are found in environments with a more neutral pH level. This feature should help the drug spare healthy cells.

The Arch drug also comes with additional cancer killing features alongside promoting autophagy. The company says its antibodies directly kill tumors through necrosis, a cell injury that leads to cell death. In addition, the antibodies induce damage-associated molecular patterns, molecules released from damaged or dying cells that activate a response from the innate immune system. Research published last year in Molecular Cancer Therapeutics showed antitumor activity in xenografts, which are transplanted tumor cells implanted in mice. In monkey studies, the drug was shown to be safe and well tolerated.

All these features form the basis of what Arch believes could make its drug the best in this new class of cancer immunotherapies. That class of drugs is currently led by magrolimab, a CD47-blocking antibody that Gilead Sciences added to its pipeline last year via its $4.9 billion acquisition of Menlo Park, California-based Forty Seven.

Forty Seven had been developing magrolimab for several types of blood cancer. It aimed to overcome the anemia risk by administering a priming dose that gets rid of old red blood cells but spares younger ones that don’t express the “eat me” signals. The priming dose was followed later by a maintenance dose. Magrolimab is currently in Phase 3 testing in myelodysplastic syndrome.

I-Mab Biopharma aims to block CD47 without requiring an initial priming dose. The Shanghai-based biotech’s lead drug candidate, lemzoparlimab, is designed to minimize its binding to red blood cells. The antibody is currently in early-stage clinical testing in the U.S. AbbVie saw enough promise in the drug to pay $180 million up front last year for global rights to the drug. That deal excludes China, Macau, and Hong Kong, where I-Mab will continue to own development rights. Meanwhile, Trillium Therapeutics of Cambridge, Massachusetts, has CD47-targeting drugs in early-stage clinical development under a partnership with Pfizer.

Lead Arch program AO-176 is currently in Phase 1/2 testing by itself and in combination with paclitaxel, a chemotherapy, in solid tumors and multiple myeloma. Furthermore, the company plans to test the antibody in combination with Merck’s blockbuster immunotherapy pembrolizumab (Keytruda) in solid tumors. The new capital also gives the company the financial support to test its lead drug candidate in combination with standard cancer treatments in multiple myeloma, and o explore other cancers and drug combinations.

Arch traces its origins to Washington University and the CD47 research of William Frazier, a professor of biochemistry, molecular biophysics, cell biology, and biomedical engineering. That work led to a startup called Vasculox, which later was renamed Tioma Therapeutics and set up a site in Brisbane.

In 2016, Tioma unveiled an $86 million Series A round of funding. Three years later, renamed Arch Oncology, the company closed a $50 million Series B round to continue early clinical development of its lead drug candidate. In addition to its San Francisco Bay Area headquarters, the company continues to maintain a laboratory in St. Louis.

Arch’s latest financing added new investors Adage Capital Management, Point72 Asset Management, Avego Healthcare Capital, FMB Research and Broadfin Holdings. Earlier investors including Roche Venture Fund, RiverVest Venture Partners, and Lightchain also participated in the Series C financing.