Bristol Myers Squibb hasn’t splashed out as much money as some of its peers in the fast-growing field of antibody drug conjugate (ADC) cancer therapies, but the pharmaceutical giant just struck a deal that could help it stand apart from some of them.

BMS is paying $100 million up front to acquire an Orum Therapeutics drug candidate ready for Phase 1 testing in certain blood cancers. Milestone payments tied to the deal could bring Orum $80 million more.

Privately held Orum is among the companies developing ADCs, drugs that chemically link a tumor-killing drug payload to an antibody in order to deliver a targeted strike to cancer cells, sparing healthy cells. In an ADC, the drug payload is often a chemotherapy, but it doesn’t have to be. Orum, which splits its operations between Lexington, Massachusetts, and Daejon, South Korea, is developing ADCs carrying drug payloads that either degrade or stabilize the target cancer protein.

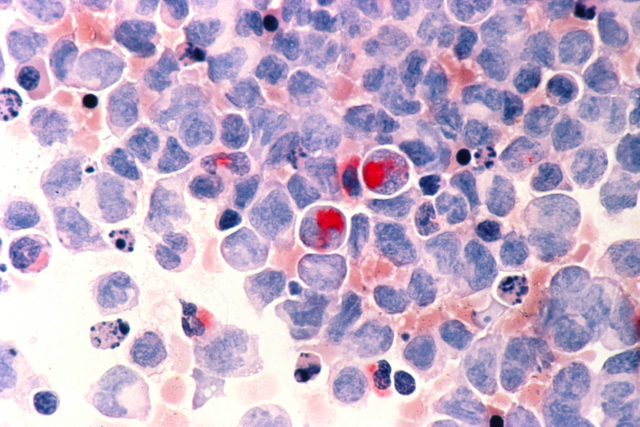

ORM-6151, the ADC heading to BMS, is a degrader in development for acute myeloid leukemia (AML). The drug is also a potential treatment for high-risk myelodysplastic syndromes, a group of blood cancers. The target of this ADC is a cancer protein called CD33.

CD33 has already been targeted by an ADC called Mylotarg. This Pfizer drug, initially approved for treating AML in 2000, was a pioneer in the ADC field, but safety issues have limited its commercial potential. ADCs have come a long way since Mylotarg first entered the market. In recent years, big pharma companies have been actively striking deals to add these drugs to their pipelines. AstraZeneca’s alliance with Daiichi Sankyo has yielded the HER2-targeting ADC Enhertu, now a blockbuster product. Pfizer is in the process of closing its $43 billion acquisition of Seagen, an ADC specialist. Merck is expanding its ADC scope, agreeing last month to pay $4 billion up front to share in the development of three Daiichi Sankyo ADCs. GSK also added an ADC contender, striking a deal for certain rights to a Hansoh Pharma ADC in early clinical development.

The big pharma deals of BMS’s rivals span traditional ADCs. Orum describes its protein degrading and stabilizing ADCs as next-generation versions of this therapeutic modality. But the biotech isn’t the only company taking this approach to treating cancer. In September, targeted protein degradation specialist Nurix Therapeutics announced a partnership with Seagen to develop new drugs that they describe as “targeted protein degraders.” Seagen is paying Nurix $60 million up front to begin the alliance, spanning multiple targets that were not disclosed. Milestone payments could bring Nurix up to $3.4 billion. Pfizer will inherit this alliance after its Seagen acquisition closes.

BMS has made other ADC deals, albeit smaller ones. In 2021, it paid $650 million up front to begin a collaboration on an Eisai ADC that targets folate receptor alpha to treat various solid tumors. Earlier this year, BMS paid Tubulis $22.7 million up front to license the startup’s ADC technology and drug payloads for use in the development of therapies addressing solid tumors. The BMS pipeline currently lists a BCMA-targeting ADC in Phase 1 development for multiple myeloma and a Claudin 18.2-targeting ADC in Phase 1 testing for solid tumors.

Meanwhile, Orum still five other ADCs in its pipeline, four degraders and one stabilizer. Targets for all of them are undisclosed except for lead program ORM-5029, which is currently in Phase 1 testing in patients whose solid tumors express the cancer protein HER2. This program was developed with the same technology used to develop the ADC heading to BMS.

“We believe this agreement with Bristol Myers Squibb, a global leader in cancer with a strong legacy in protein degradation, validates Orum’s unique Dual-Precision Targeted Protein Degradation approach, which we pioneered to improve the therapeutic window and realize the full potential of targeted protein degraders through precision delivery to cancer cells via antibody drug conjugates,” Orum CEO Sung Joo Lee said in a prepared statement.

Public domain image of acute myelocytic leukemia from the National Cancer Institute