The mpox outbreak is a memory, but Bavarian Nordic, maker of the only FDA-approved vaccine for the pathogen behind this viral infection, turned skyrocketing demand for its product into record revenue. With that growth comes a need to focus, and the pure-play vaccines company is getting out of the business of developing vaccines for cancer.

Bavarian Nordic’s lone cancer vaccine candidate, TAEK-VAC, had reached Phase 1 testing as a potential treatment for chordoma or HER2-positive breast cancer. But this program had also reached the point where further investment is needed, and Bavarian Nordic decided it needs to focus its R&D efforts on infectious disease, the Denmark-based company said Wednesday in its announcement of preliminary 2023 financial results.

“As a consequence, the TAEK-VAC project will not be continued, and the company has no further plans to invest in immuno-oncology vaccine development,” Bavarian Nordic said.

A cancer vaccine is a type of immunotherapy that gets the body’s immune system to seek out and destroy cancer cells. Bavarian Nordic’s cancer vaccine candidate was developed with the same proprietary platform technology that yielded its other vaccines, including Jynneos, the company’s approved vaccine for protecting against infection from both mpox and smallpox.

Within two years of Jynneos’s 2019 approval for mpox (formerly known as monkey pox), it became Bavarian Nordic’s top-selling product. Sales surged during the 2022 mpox outbreak, and demand for the product is continuing. In its report of third quarter 2023 financial results, Bavarian Nordic listed 2.9 billion Danish krone (about $420 million) in Jynneos revenue for the nine months ended Sept. 30, a 316% increase in sales compared to the same period in the prior year.

Bavarian Nordic’s preliminary financial results for 2023 do not break out revenue by product. But the company said Wednesday that its preliminary revenue for the year topped 7 billion Danish krone (about $1 billion) a more than 124% increase compared to 2022. The company attributed this growth in part to the surge in sales of Jynneos. While the company acknowledged that demand is decreasing as the number of mpox cases falls, this vaccine is still finding traction as a product sold to government bodies and organizations that respond to outbreaks. Preliminary public preparedness revenue in 2023 topped 5 billion Danish krone (about $730 million).

By dropping its cancer R&D, Bavarian Nordic avoids potential competition with companies further along in cancer vaccine development. Before BioNTech found success with its Pfizer-partnered vaccine for Covid-19, the company’s messenger RNA research focused on cancer. BioNTech’s most advanced cancer vaccine candidate is in mid-stage testing as a potential treatment for advanced melanoma. Moderna has two mRNA vaccines in pivotal testing for melanoma under a 50/50 partnership with Merck. Moderna also has wholly owned mRNA cancer vaccines in early clinical development. Meanwhile, Gritstone Bio’s most advanced cancer vaccine is in Phase 2/3 testing in colorectal cancer.

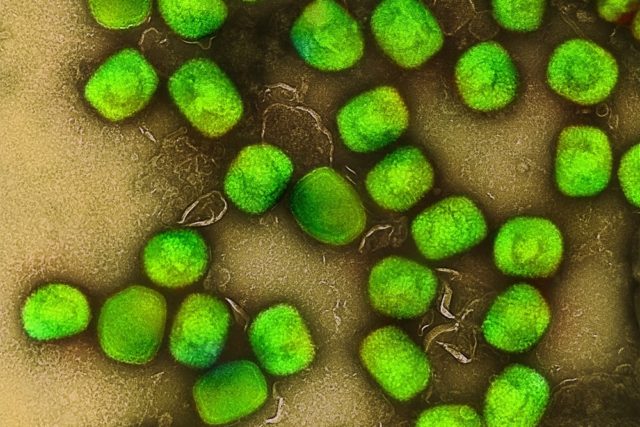

Public domain image by the National Institute of Allergy and Infectious Diseases